With the new year comes the excitement to start strong and make meaningful progress toward our ambitions. But before diving in, it’s worth taking a moment to reflect on the trends that closed out 2024. December’s data offers a clear view of where the private lending market stands and how these patterns can inform strategies for the months ahead. From loan volumes to interest rates, the insights from Lightning Docs reveal the evolving dynamics of the industry.

Volumes

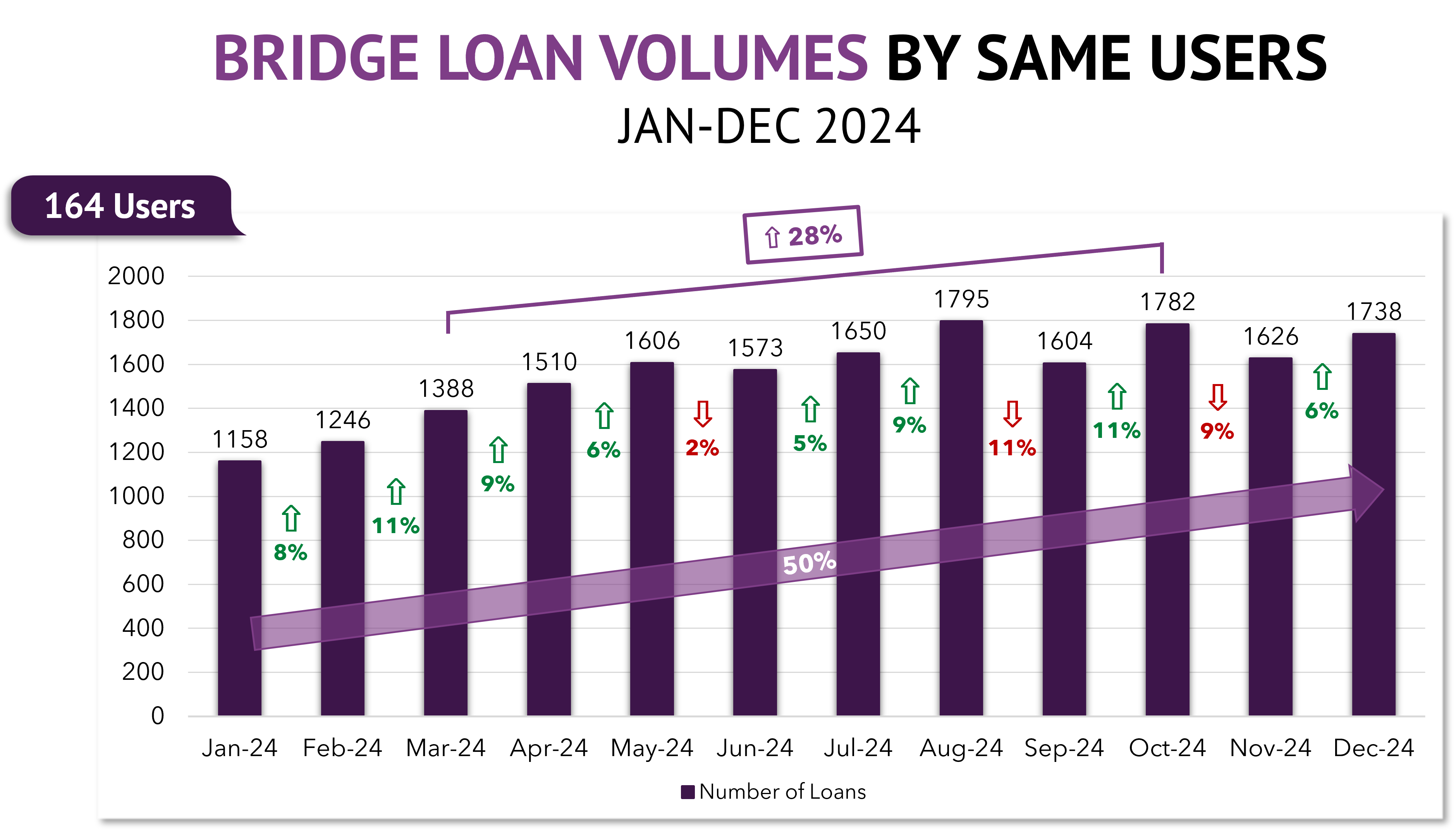

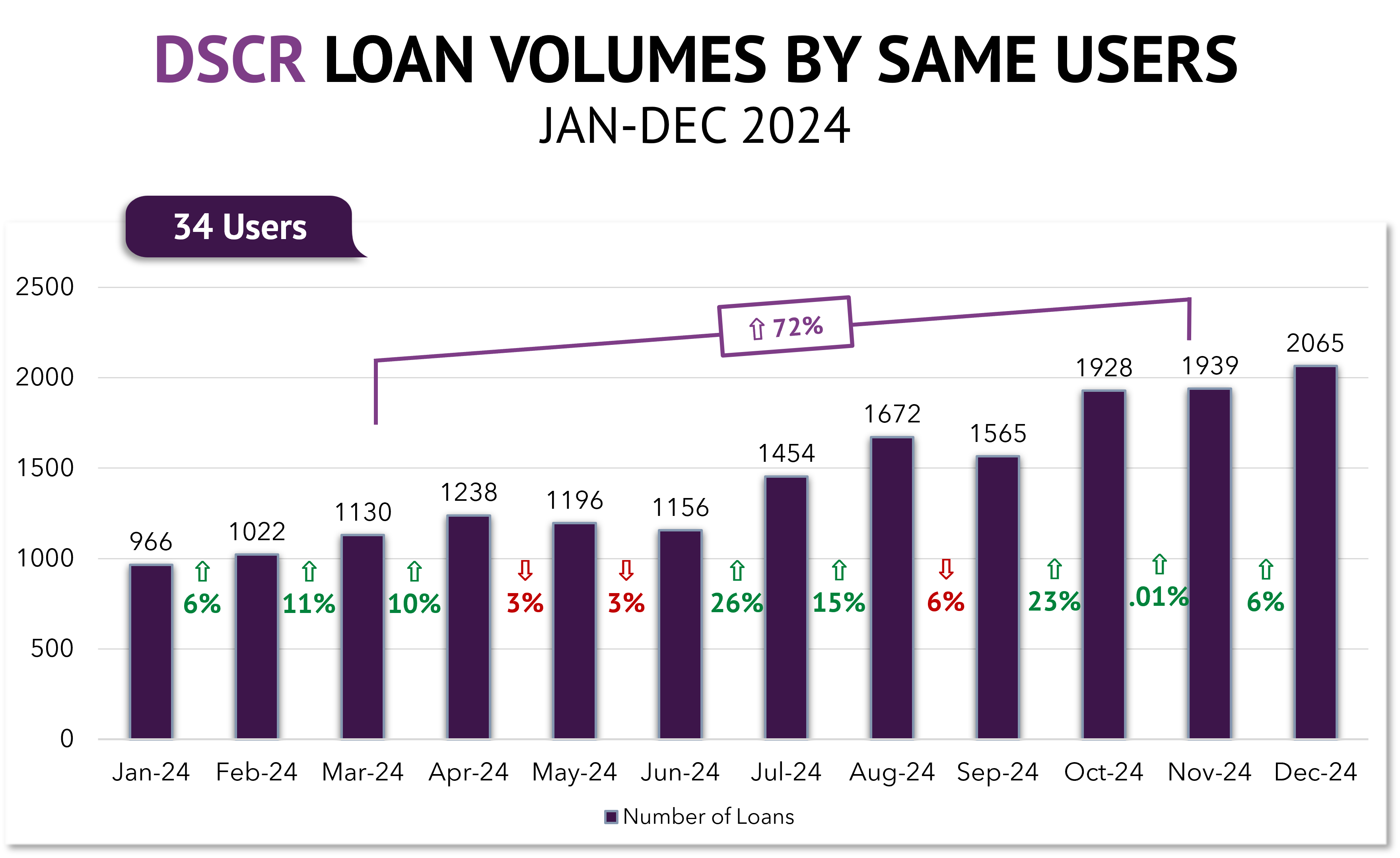

Bridge loans saw a rebound in December, with volume increasing nearly 7% compared to November. For our 164 users who joined Lightning Docs prior to January, this capped off a remarkable 50% increase in monthly loan volume throughout the year. DSCR lenders also ended the year strong, closing over 2,000 loans in December. This marks a 6% month-over-month increase and an extraordinary 113% rise since January. Typically, December represents a slowdown in business so it will be worth watching to see if that is delayed until January 2025 or if this upward trend continues.

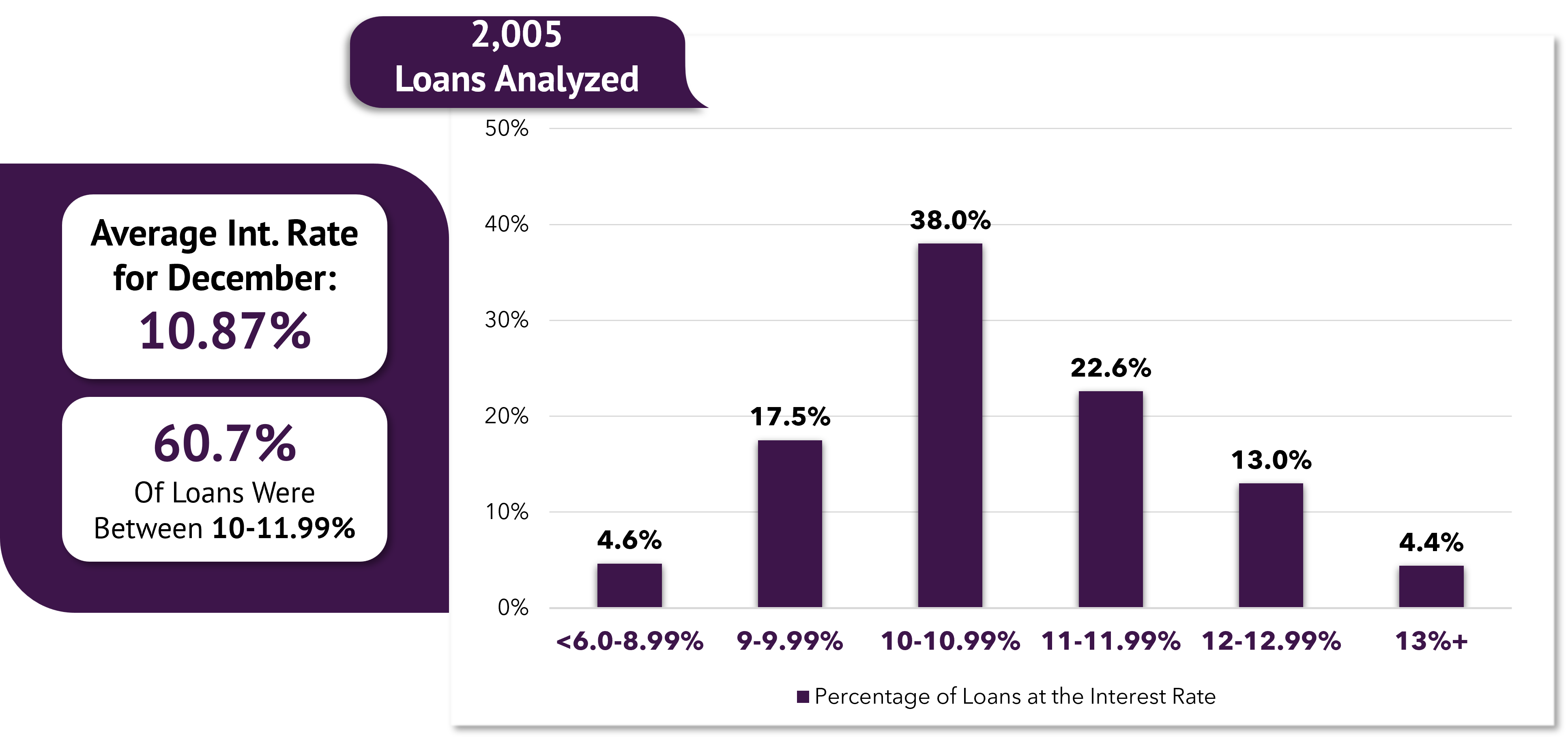

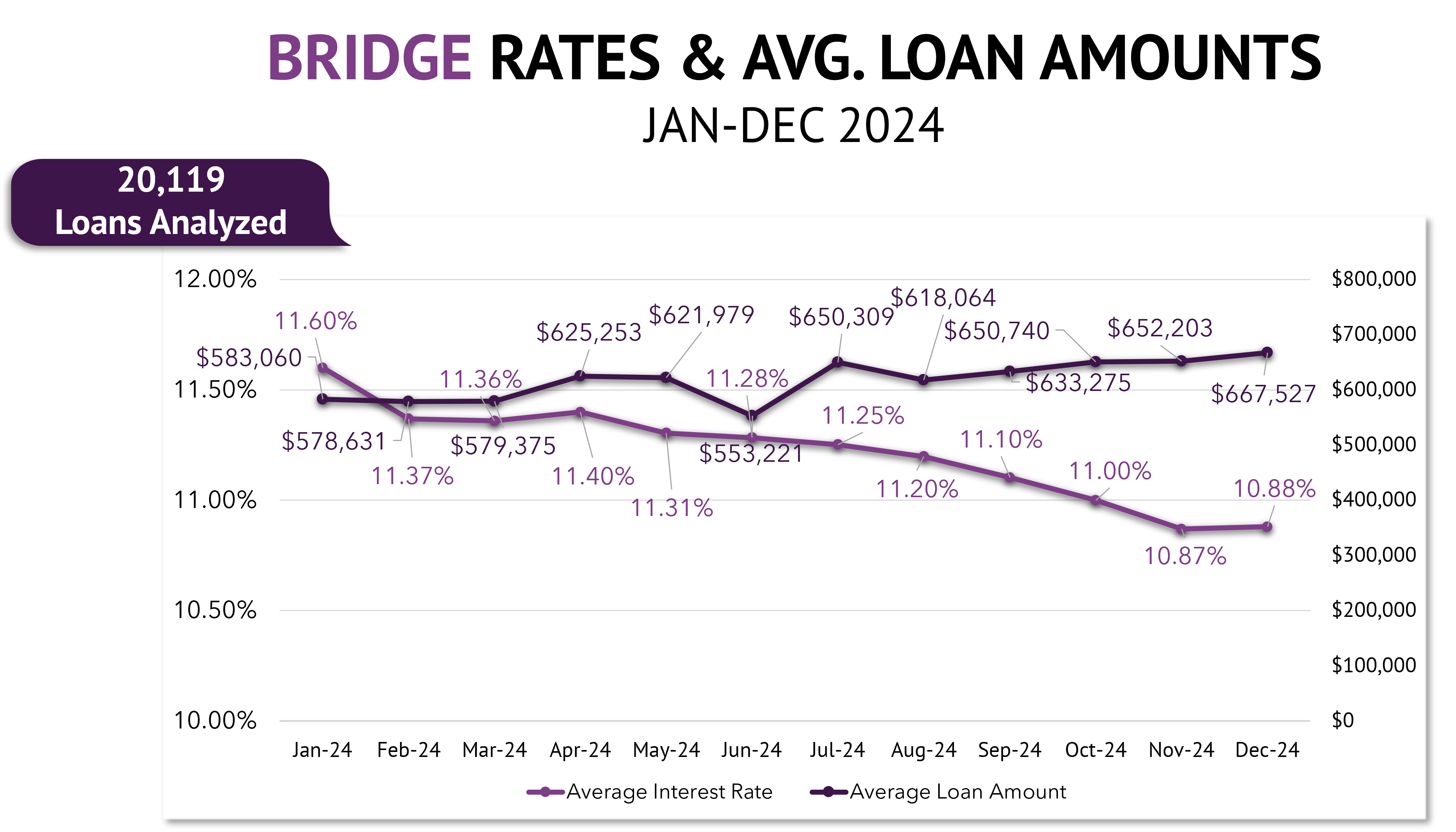

December 2024 RTL Rates

RTL interest rates remained nearly identical to November with a 10.87% national average. However, when segmenting interest rates, it becomes clear that market participants must understand their local market to make pricing determinations. For example, interest rates varied between 9-12.99% with only 38% of loans falling between 10-10.99%.

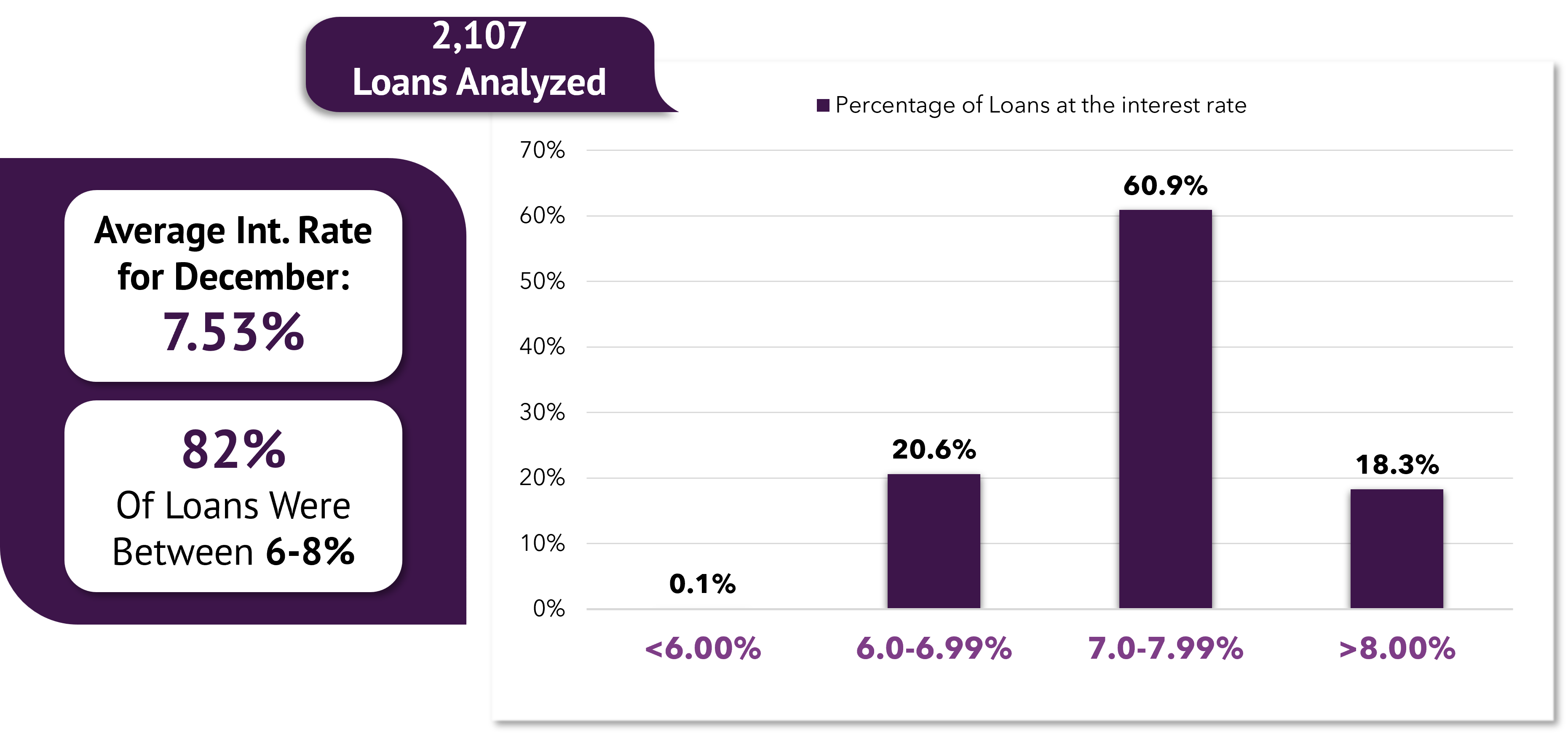

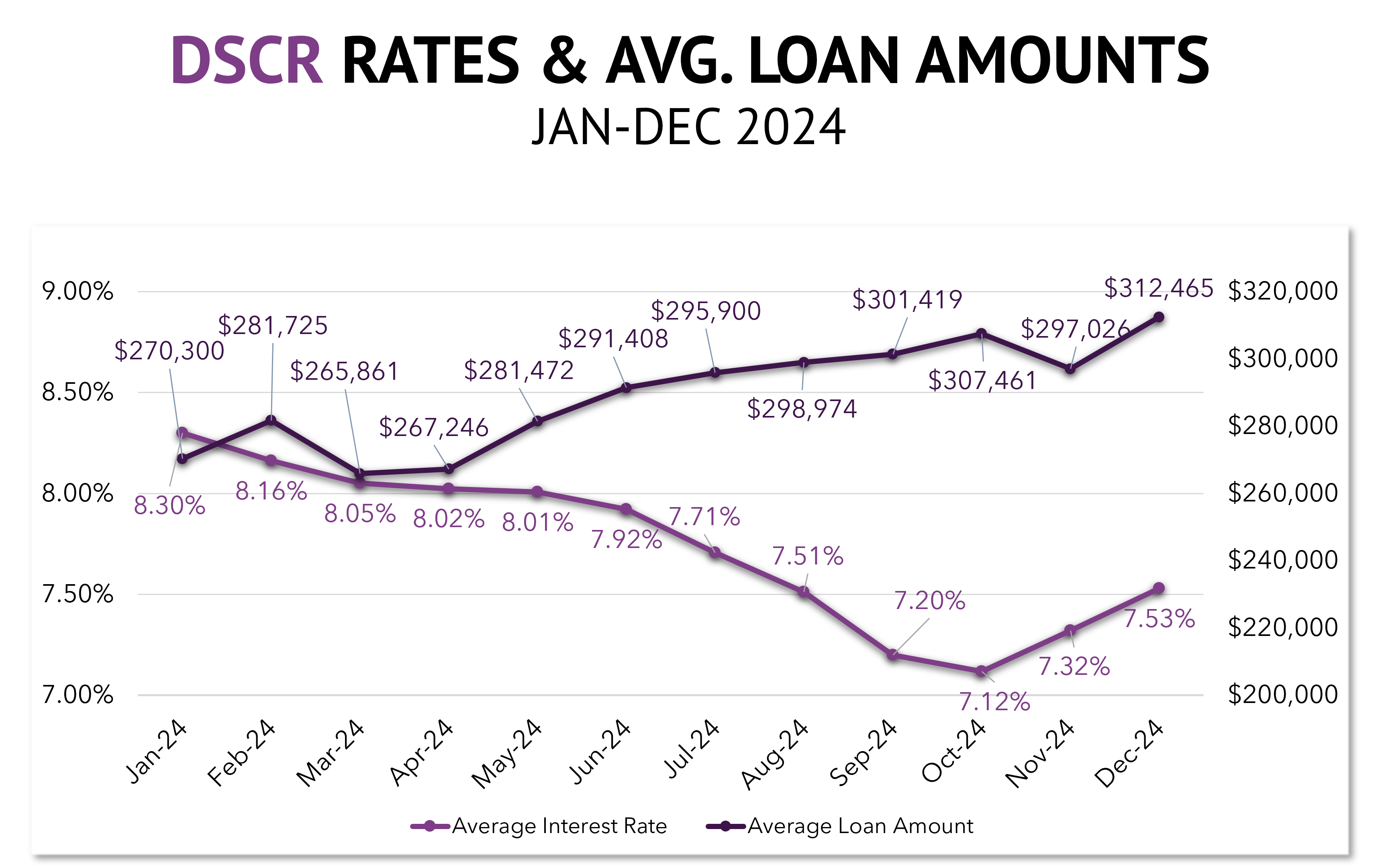

December 2024 DSCR Rates

The national DSCR interest rate average rose to 7.53% in December, up from 7.32% in November. Additionally, rates concentrated further around the mean, with 60% of loans written between 7-7.99%.

Average Loan Amounts

RTL loan balances saw a slight increase nationally from around $652,000 in November to $667,000 on average. For DSCR, just like we saw an uptick in interest rates, loan amounts also grew from around $297,000 in November to over $312,000 in December.

This December has shown us to expect the unexpected. Unprecedented growth during a time of year that typically slows down may signal stronger momentum heading into 2025. The first few months of the year often start at a slower pace, but if December is any indication, we could see continued growth in the market.

For a deeper dive into December’s insights, click the link below to receive the full report. Stay tuned for the release of our comprehensive 2024 Private Lending Market Report, featuring trends, forecasts, and strategies to help you excel in the year ahead.