January has come and gone, and we’re still waiting for the cyclical slowdown that typically defines the start of the year for private lending. From 2022 to 2024, January was either the lowest or second-lowest month in volume. This year, however, January 2025 became our highest-volume month to date.

We’ll break down the key metrics behind this continued surge in private lending, but if there’s one takeaway so far, it’s that the market remains full of surprises.

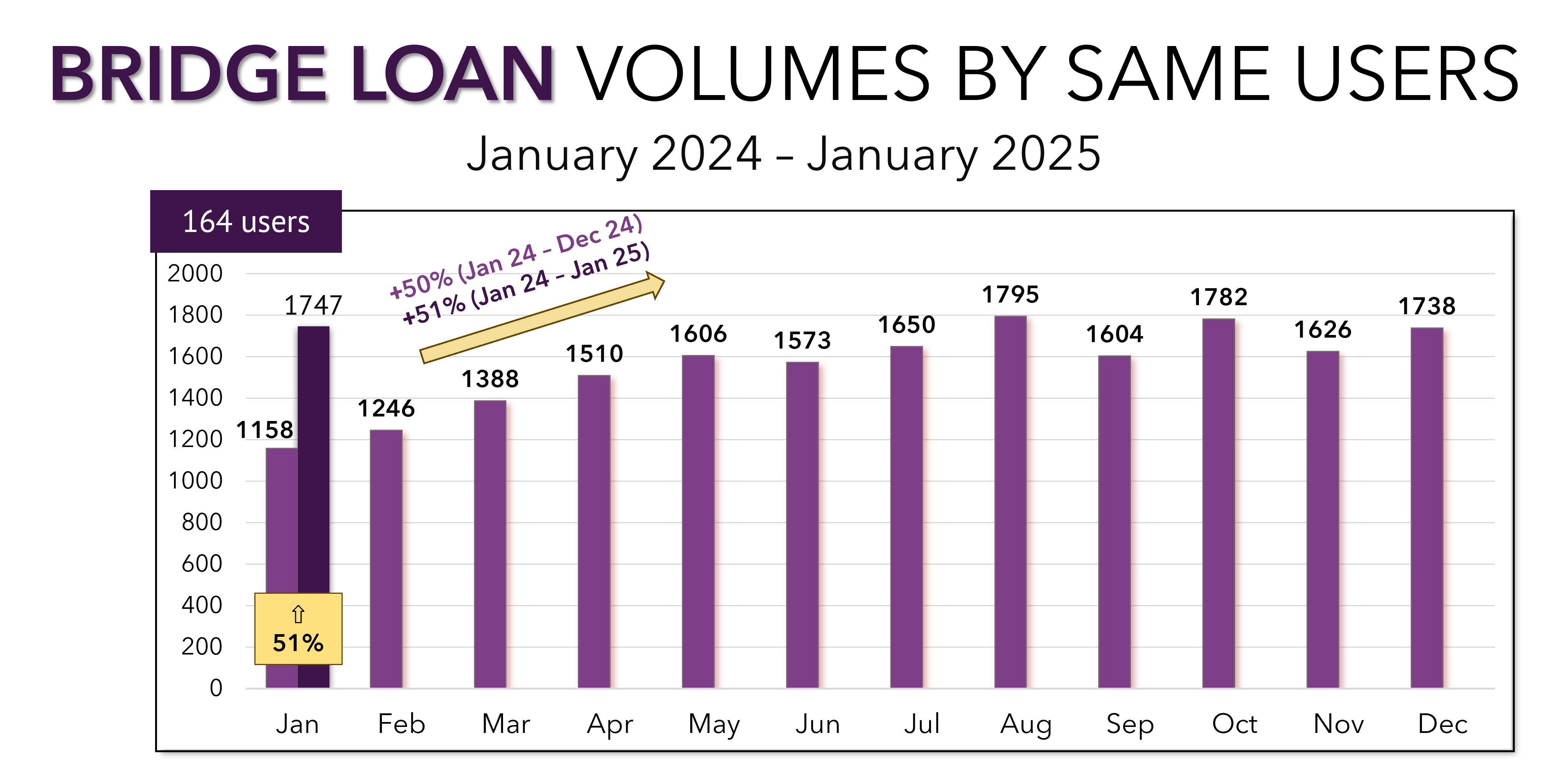

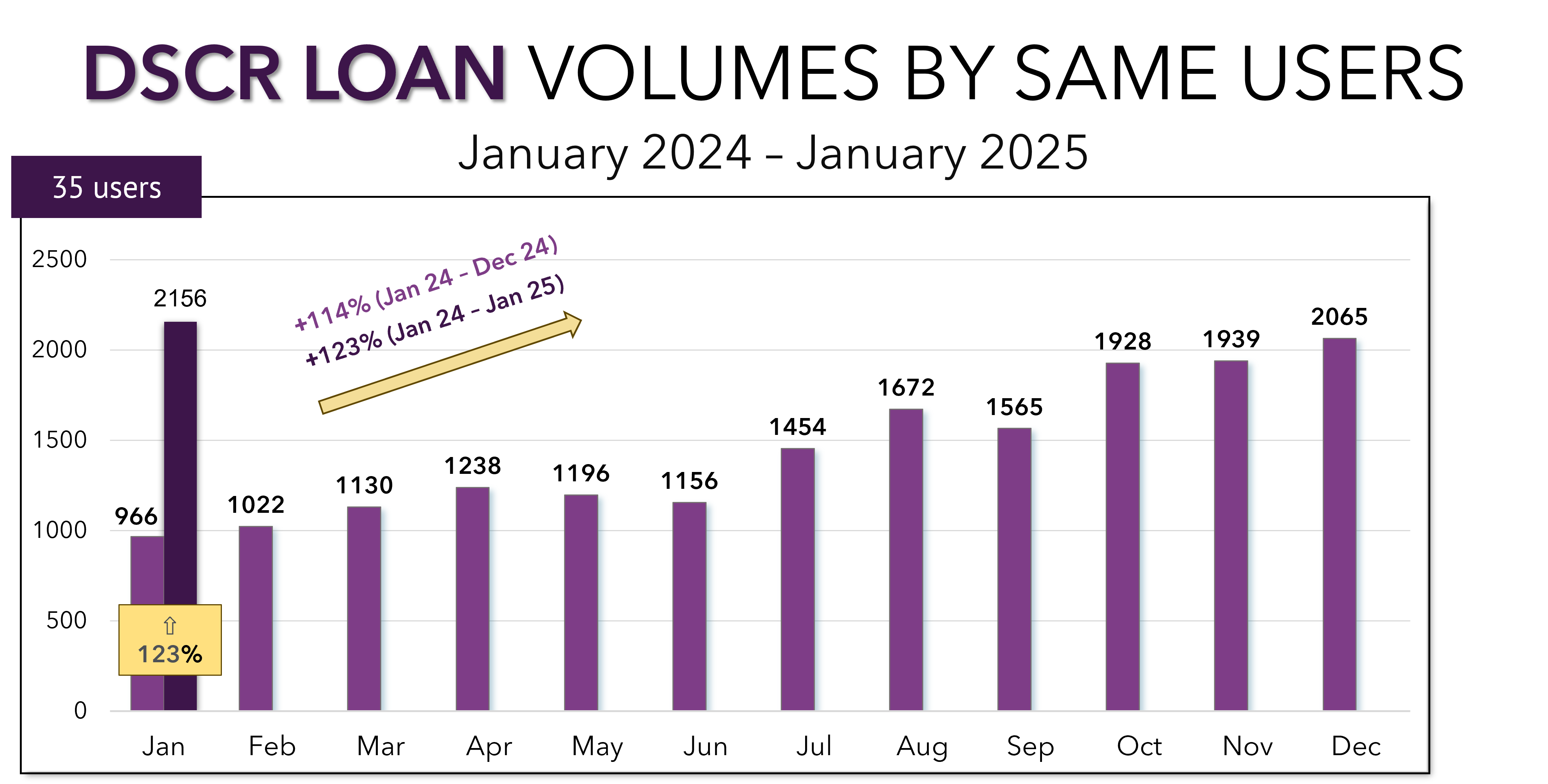

Loan Volume Trends

Following December’s strong performance, bridge loan volume ballooned with a 51% year over year increase in January comparing 2025 to 2024. DSCR loan growth once again outpaced bridge loan growth and reached its highest volume month ever recorded in our system resulting in an astonishing 123% year over year increase in January 2025.

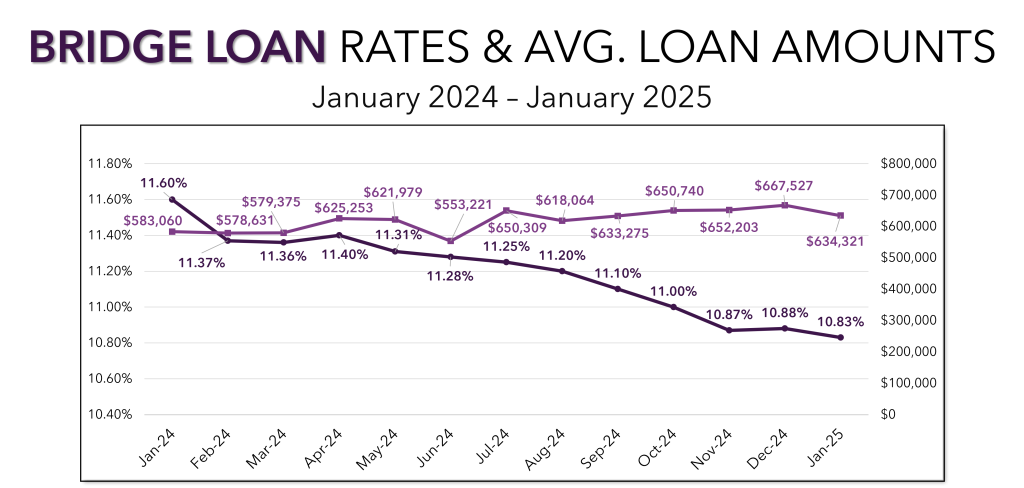

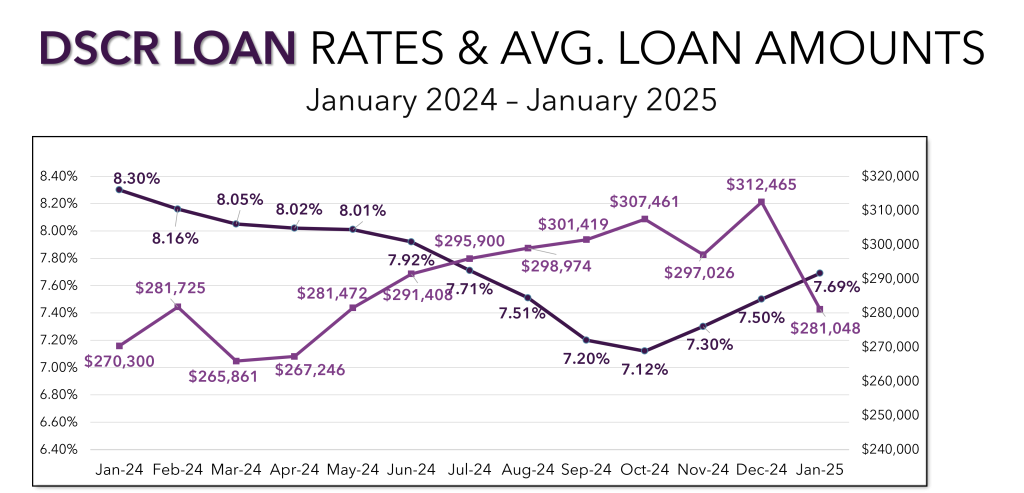

Interest Rates & Loan Sizes

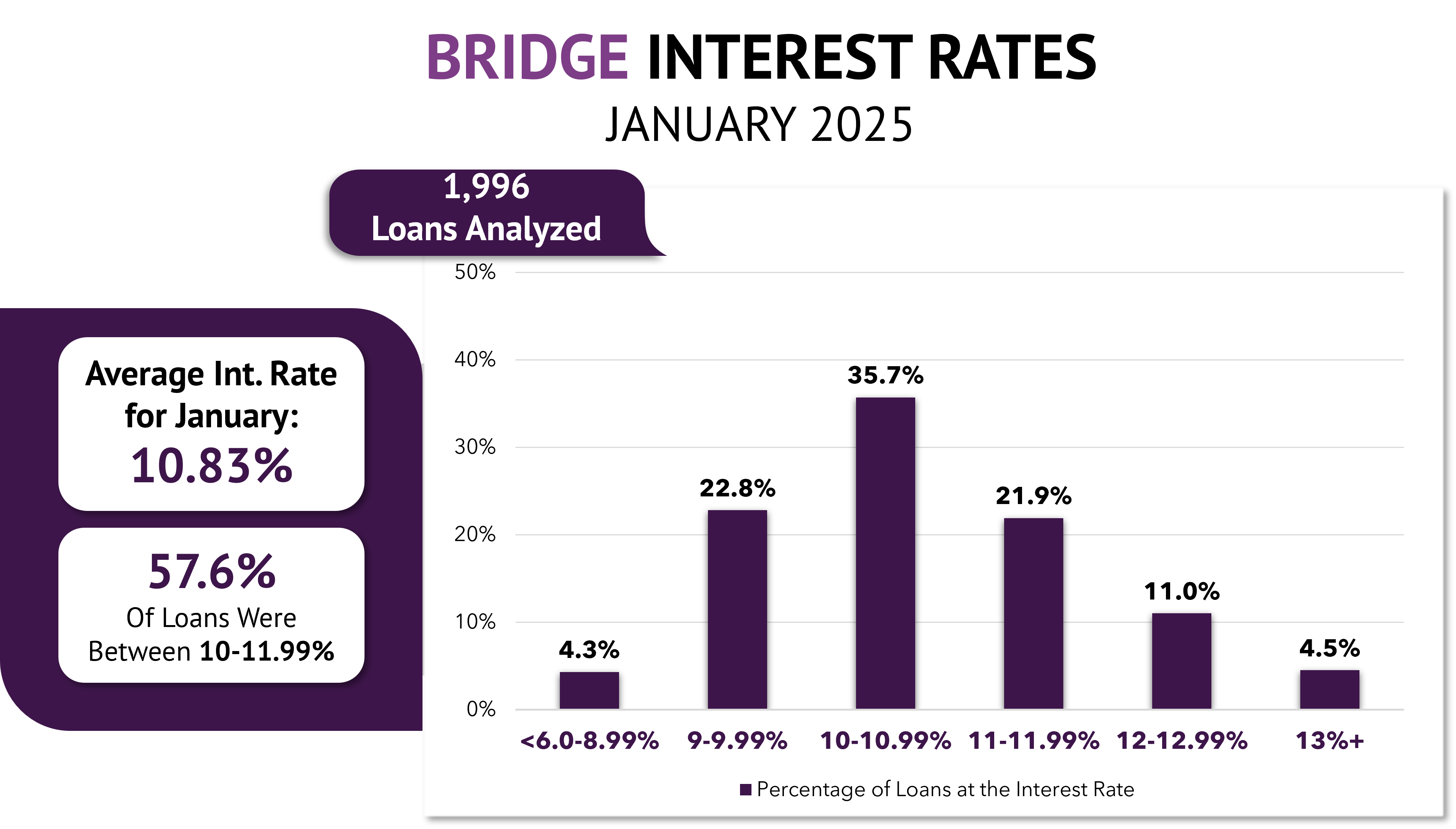

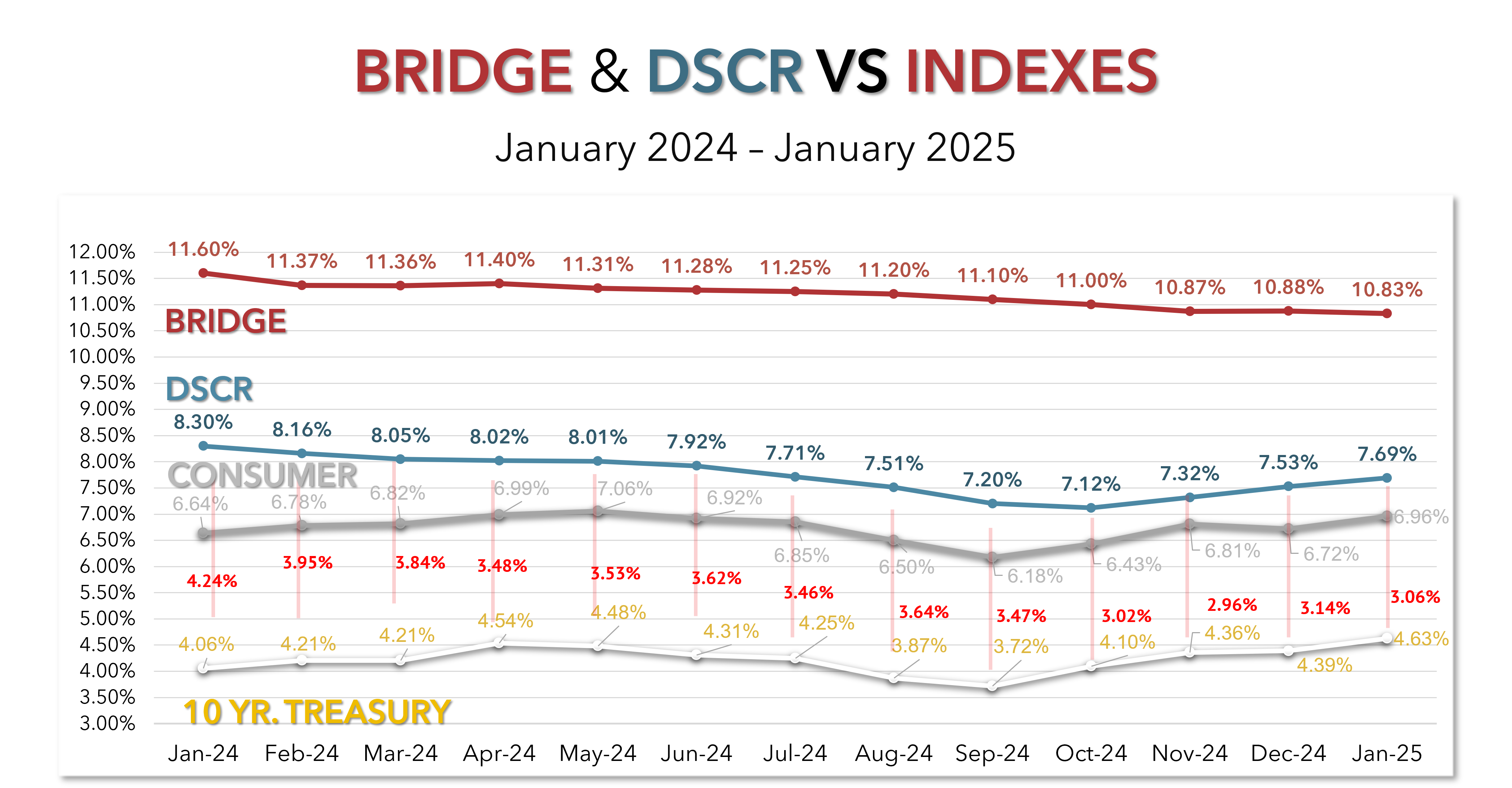

Bridge loan interest rates decreased for the eighth time in the last nine months, dropping 73 basis points since January of last year. While average loan amounts declined from $667,527 in December to $634,321 in January, they remain $50,000 higher than at this time last year.

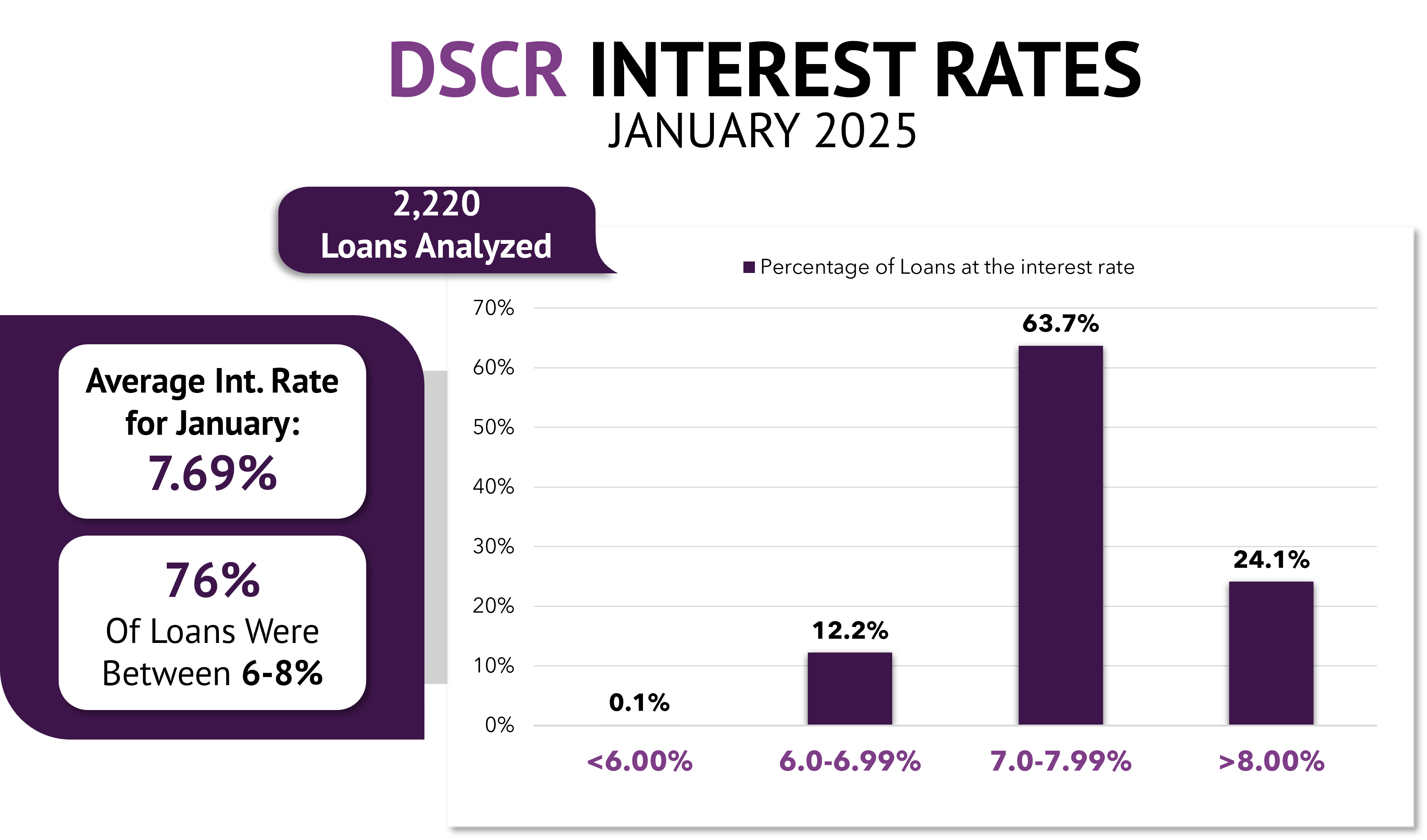

DSCR interest rates increased for the third straight month after a steady decrease throughout the first 10 months of 2024. Conversely, average DSCR loan amounts saw their biggest decrease in the last year, dropping from $312,465 to $281,048.

Interest Rates Variance

Bridge loan interest rates remained relatively stable, dipping just four basis points from December to 10.83%. More than 57% of loans fell between 10 and 11.9%, with fewer loans exceeding 12% and an increasing share below 10%.

For DSCR loans, the sub-seven percent market continued to shrink, with just over 12% of loans in that range. Nearly 64% of DSCR loans had rates between 7-7.99%, while the remaining quarter had rates above 8%

Spreads Tighten

The rise in DSCR interest rates aligns with a 24-basis-point increase in the 10-year Treasury yield this month. The good news for lenders is that the spread between the two continues to tighten, signaling strong borrower confidence in the market.

Top Markets for Bridge and DSCR Loans

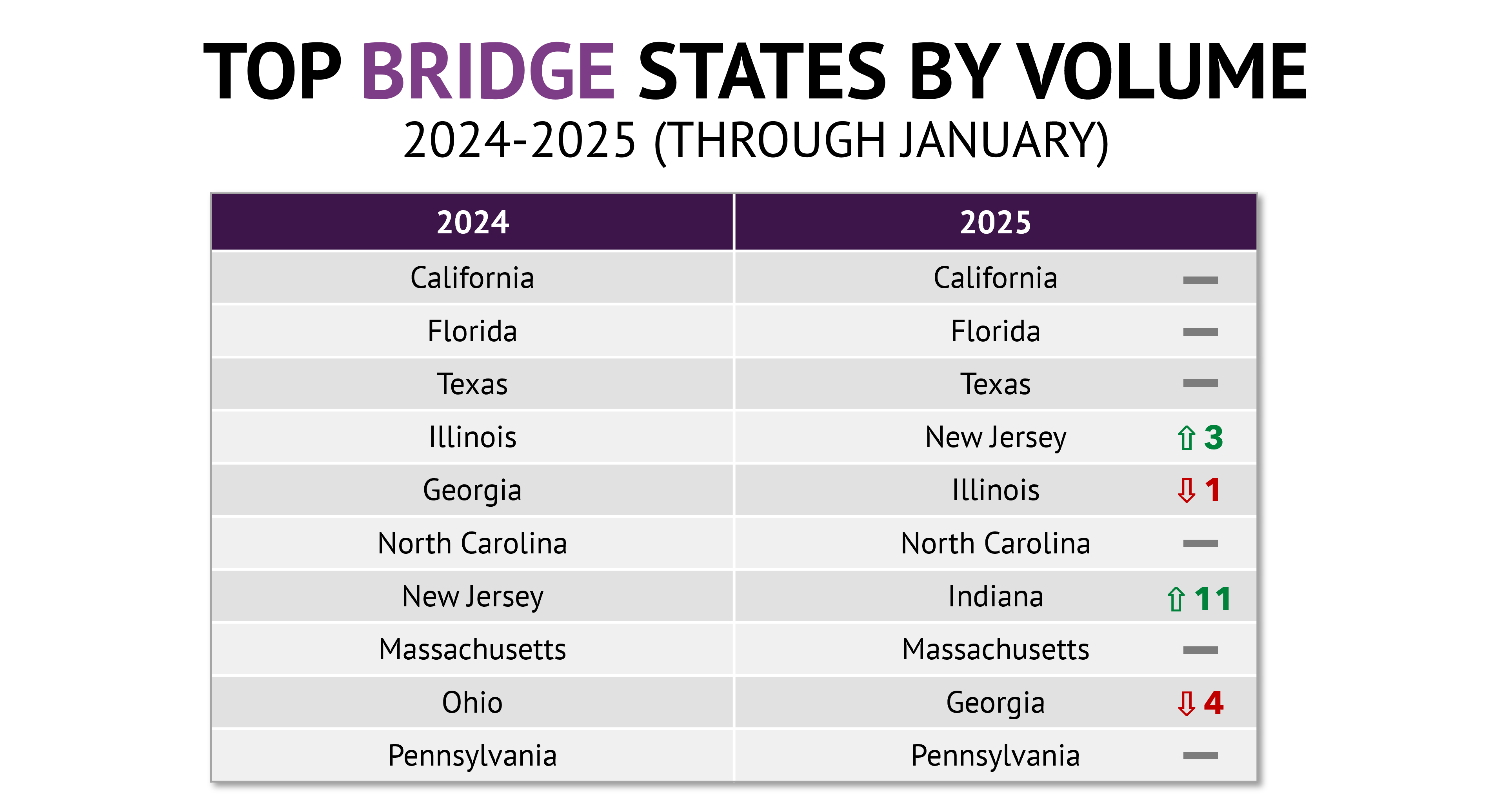

California, Florida, and Texas maintained their positions as the top three states for bridge loan volume in January. New Jersey climbed the rankings, and Indiana made a notable jump into the top ten, while Illinois and Georgia saw slight declines.

For DSCR loans, Ohio and Texas took over the top two spots. While most of the top ten remained unchanged, Missouri emerged as the only newcomer, replacing North Carolina.

January’s data serves as another reminder that private lending isn’t following the usual seasonal patterns. Instead of a slowdown, we’re seeing record-setting DSCR loan volume and strong bridge loan activity, reinforcing the resilience of the market.

The question now is whether this momentum will carry forward or if we’ll finally see a cooling period. Either way, the lenders finding success today are the ones who stay adaptable, focus on execution, and make data-driven decisions.

We’ll be keeping a close eye on February’s numbers—stay tuned for next month’s report.