December is a natural time to reflect on the past year and plan for the one ahead. 2024 was an absolutely wild ride for our Lightning Docs team and its customers. When speaking to our customers at the end of 2023, the general market sentiment suggested significant interest rate relief in 2024. Markets had initially priced in six 25 basis point cuts with initial estimates starting in March 2024.

Welp, that didn’t happen.

Unless you have been living under a rock, I don’t need to tell you what happened with the Fed rate cuts. What we can report with precision is the state of the private lending market in terms of volumes, rates, and other data trends.

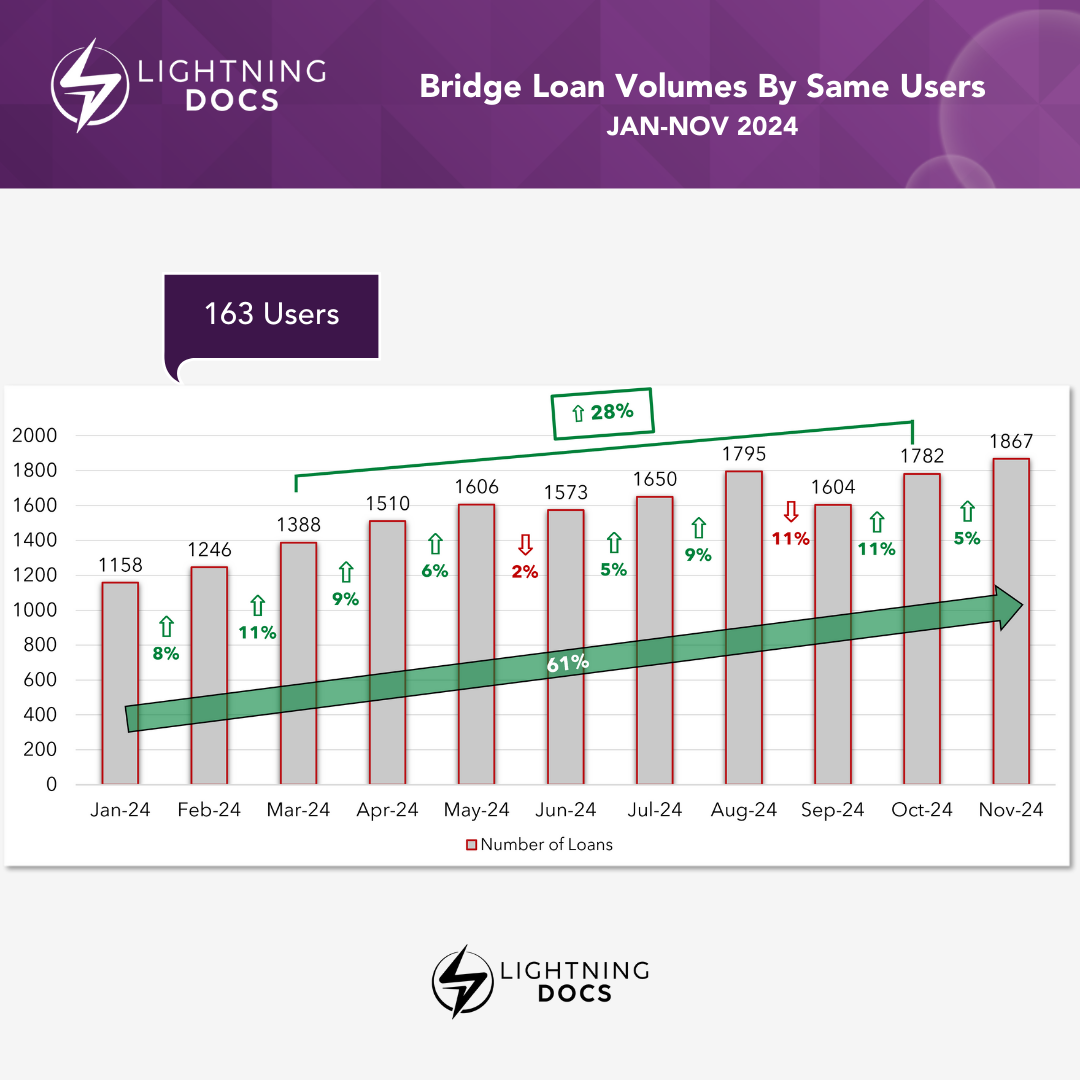

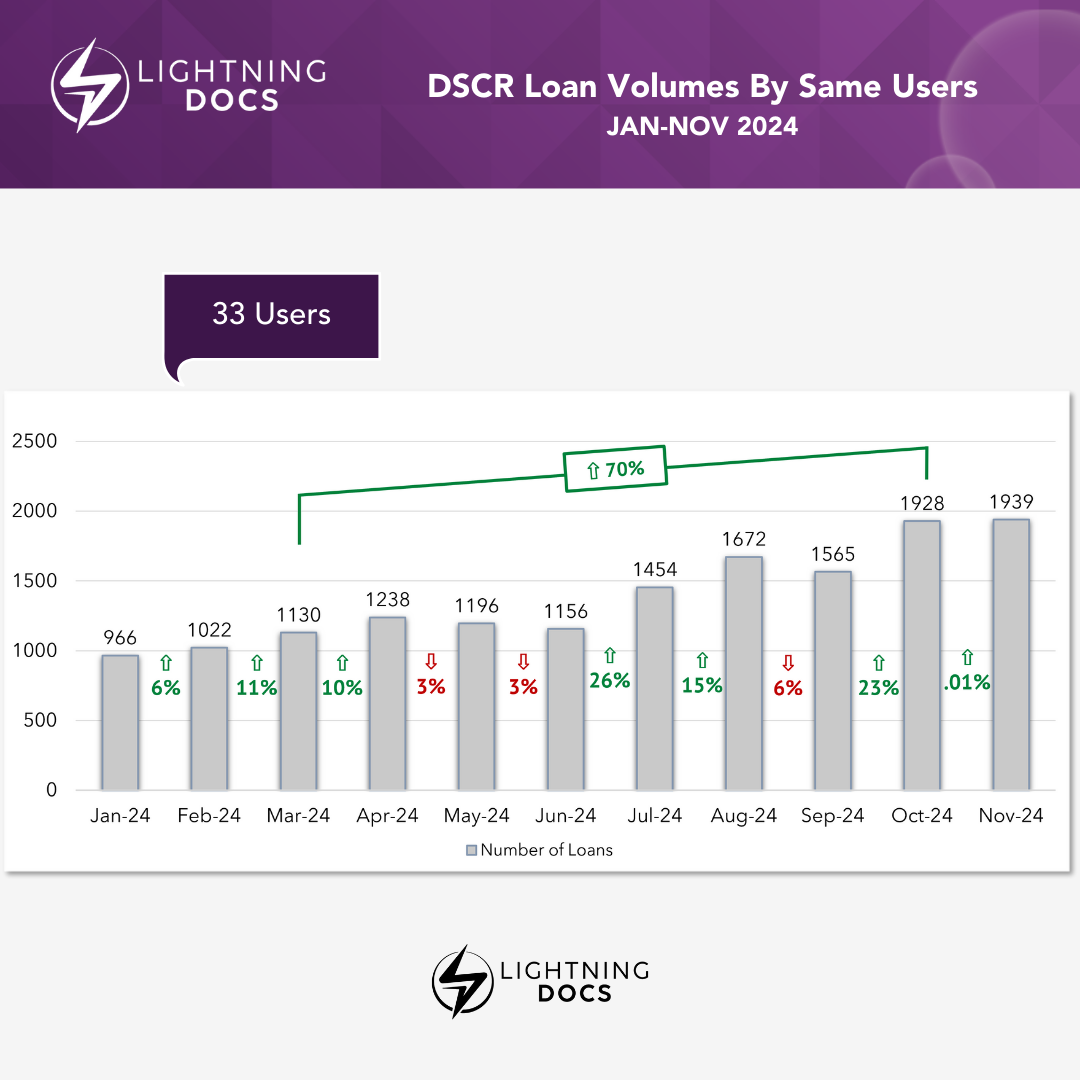

Volumes

Loan volumes exceeded most expectations for 2024. When we tracked our hundreds of users (including more than 60% of the top 50 private lenders nationally) volumes were up 29% for RTL lenders and 45% for DSCR lenders. January and February were generally soft months but by March activity had dramatically picked up for private lenders with huge increases in volume for DSCR lenders starting around July 2024 when the expectation of rates cuts really started setting in.

Rates in 2024

RTL

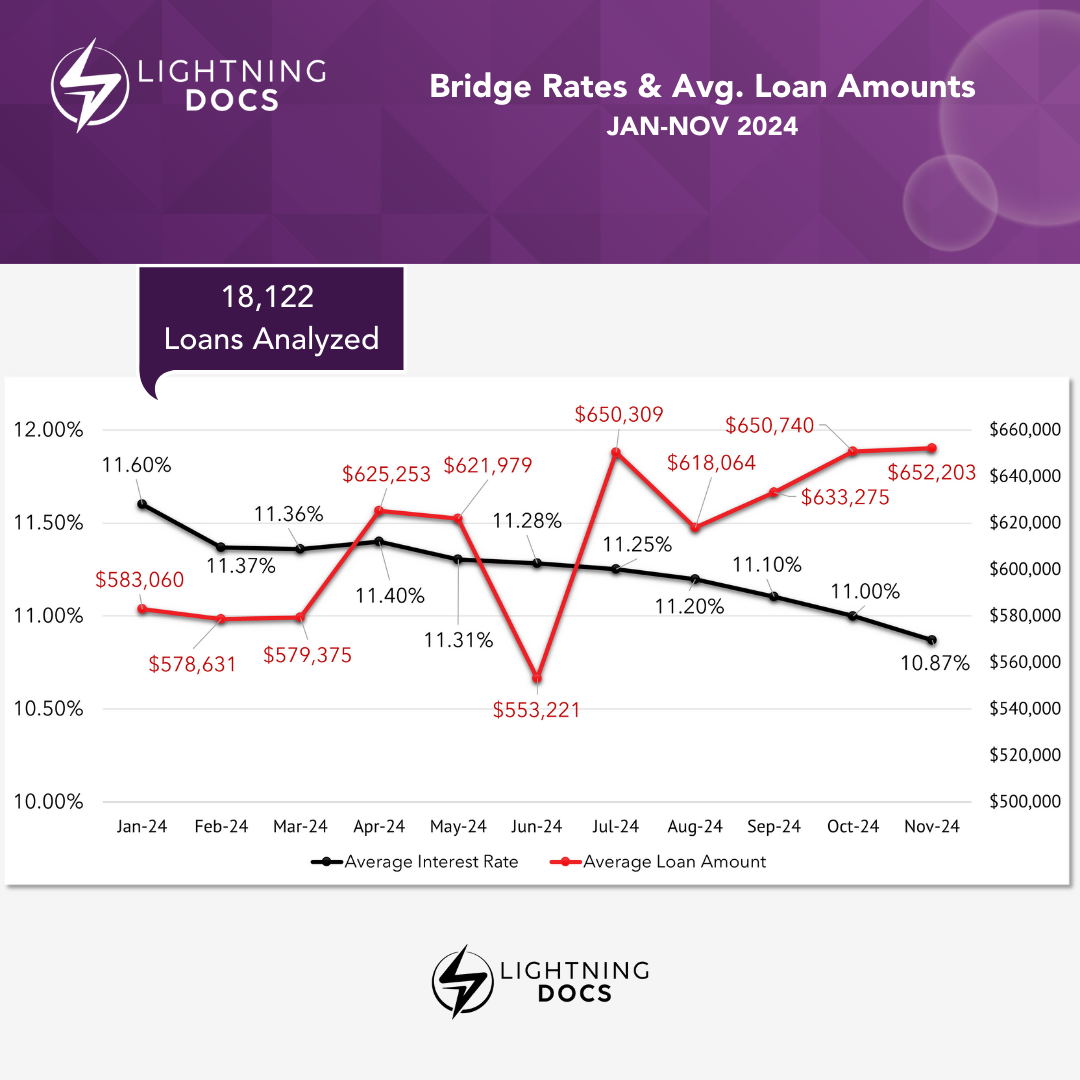

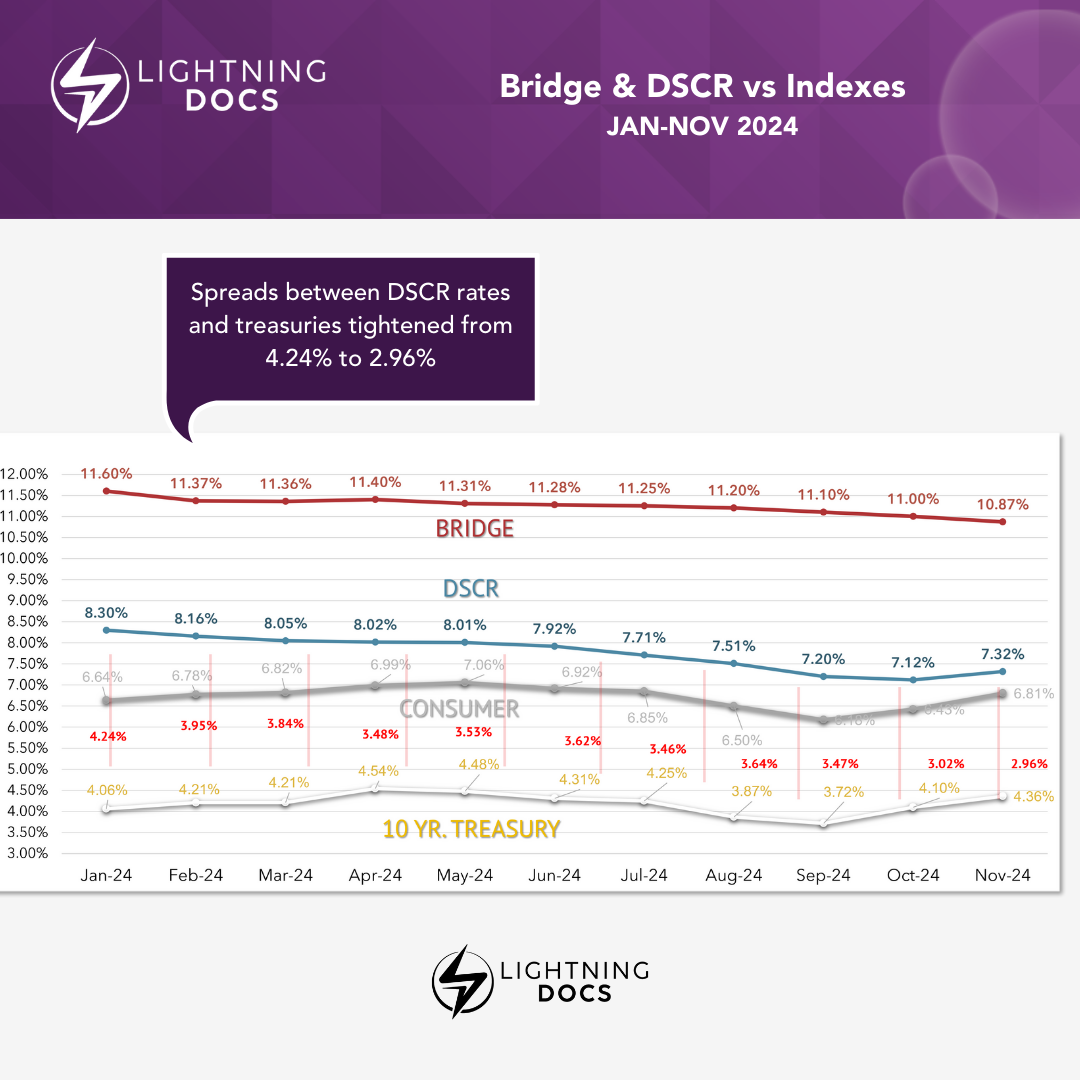

Nationally, RTL loan balances began at a high of 11.60% in January 2024, steadily declining each month to 10.87% in November.

DSCR

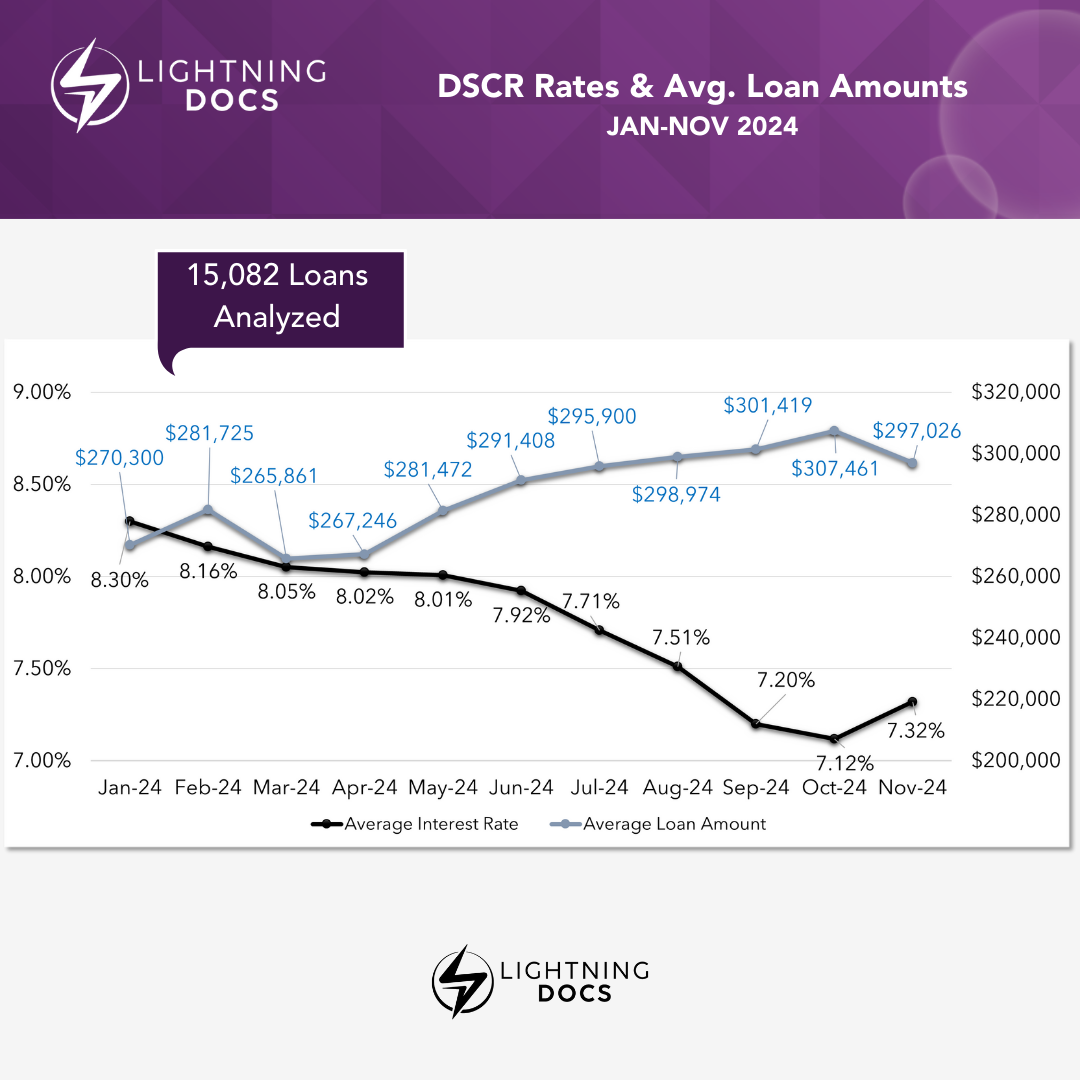

DSCR rates also declined monthly, starting at 8.30% in January and reaching a low of 7.12% in October. However, as any market observer will note, 10-year treasury yields rebounded in November, leading to a 20-basis-point increase in DSCR rates nationally. What is fascinating to watch, particularly for DSCR lenders is that the spread between 10-year treasuries and DSCR rates have dramatically tightened throughout the year. In January 2024, there was a 424 basis point spread between treasuries and average DSCR rates and that spread shrunk down to 295 basis points by November 2024. Interestingly, the 10-year treasury yield was lower in January (4.06%) compared to November (4.36%), yet average DSCR loan rates were 98 basis points lower in November (7.32%) compared to January (8.30%).

Points in 2024

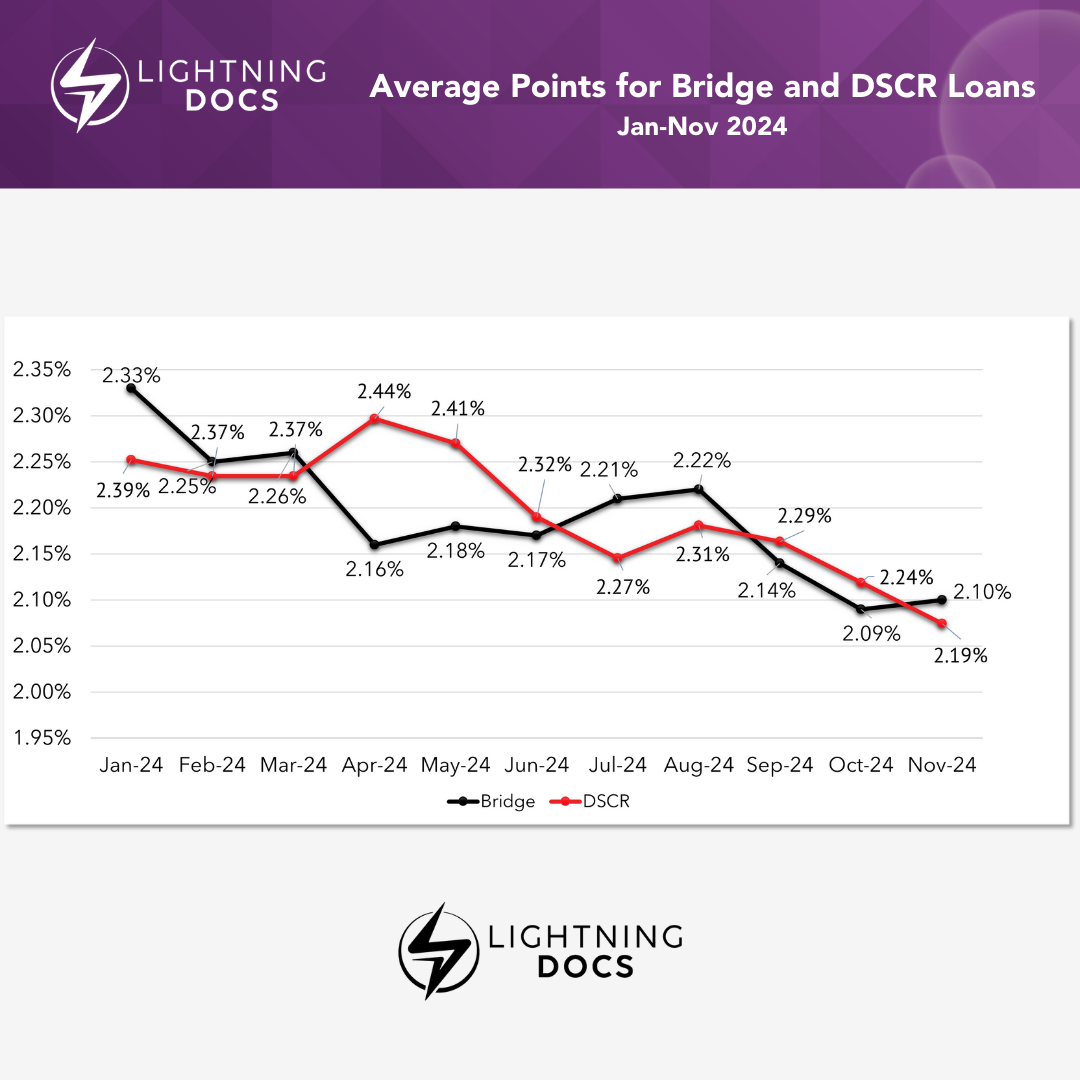

Origination/broker fees in 2024 declined slightly throughout the year, averaging around 2.3% for RTL and DSCR loans in January, and dropping about 20 basis points for each product by November.

Average Loan Amounts

RTL average loan balances generally crept up nationally from around $580,000 on average to closer to $650,000 on average. DSCR loan balances also increased from an average of around $270,000 to closer to $300,000 by the end of the year.

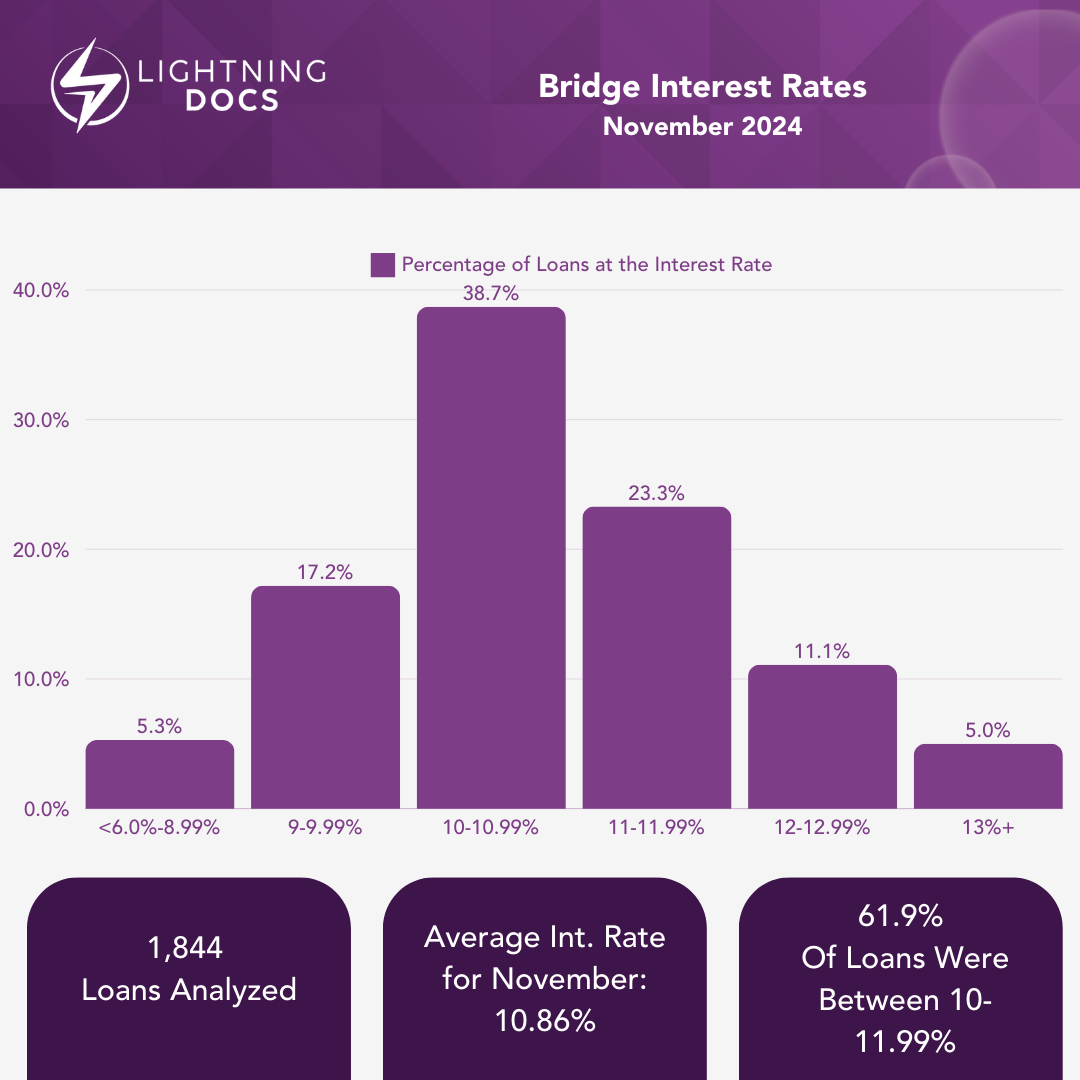

November 2024 RTL Rates

Although almost 40% of RTL loans are still between 10-10.99% nationally, there is almost an equal amount of loans priced between 9-9.99% and 11-11.99%. There is clearly strong competition for better borrowers and those that are still seeking 12%+ rates of return for their RTL loans will find themselves in the minority. This isn’t 2023.

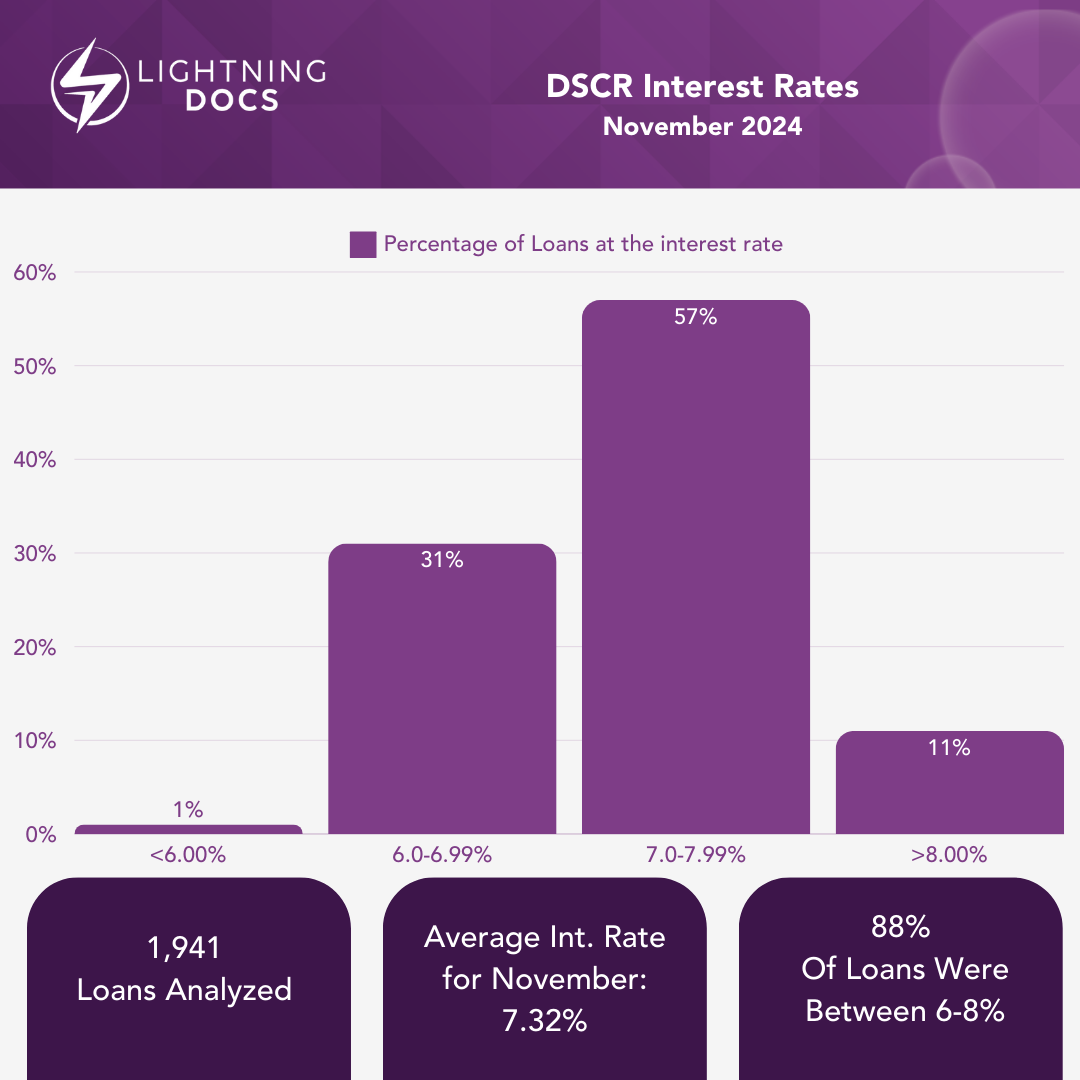

November 2024 DSCR Rates

In October 2024, there was an almost even split of transactions between 6-6.99% and 7.0-7.99%. However as the 10-year treasury has picked back up November was closer to 30/70 with an average interest rate of 7.32% for the month.

Location, Location, Location

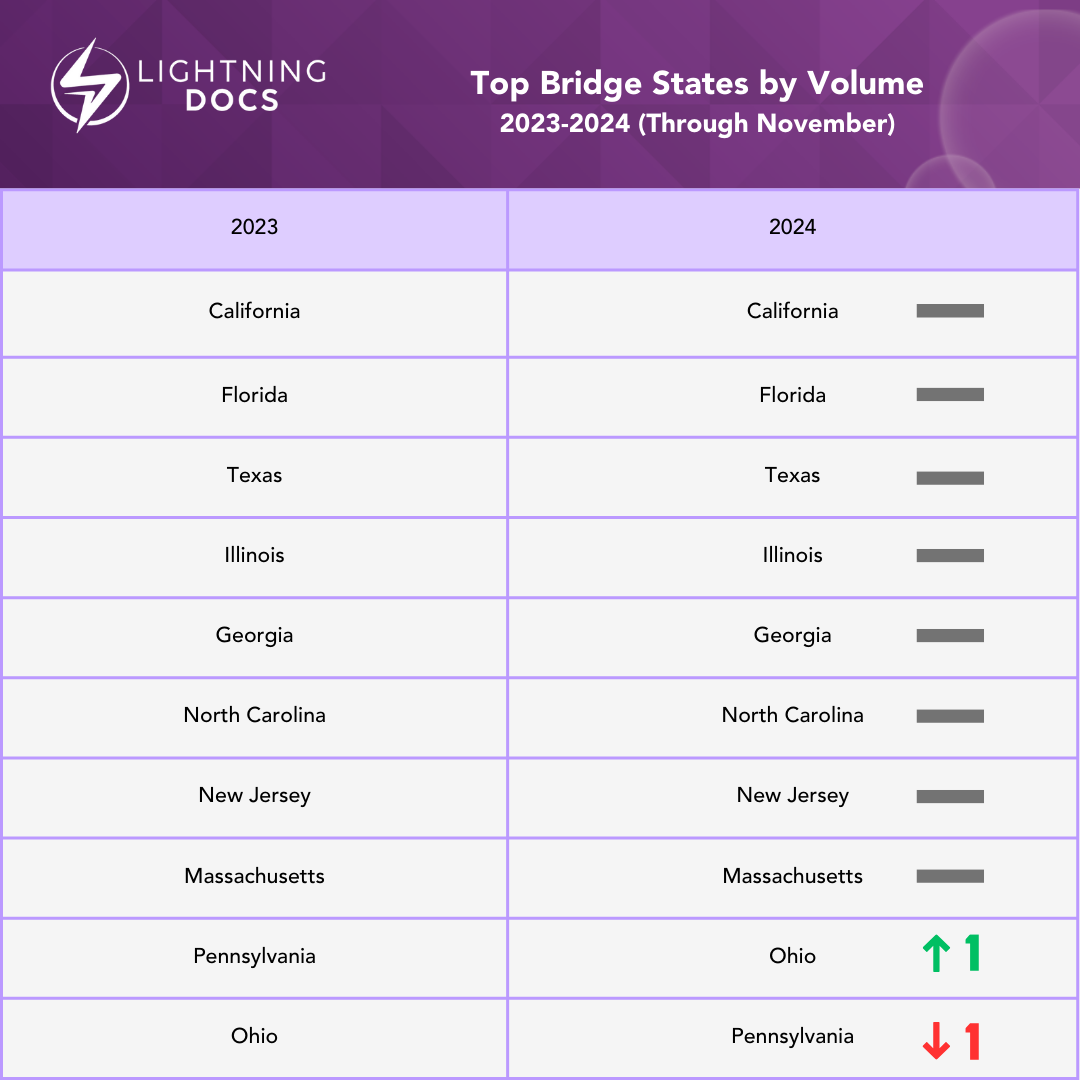

Geographical trends did not change much at all between 2023 and 2024 for RTL lenders. The top 8 states remained in their exact same position with Ohio and Pennsylvania changing one spot in 2024.

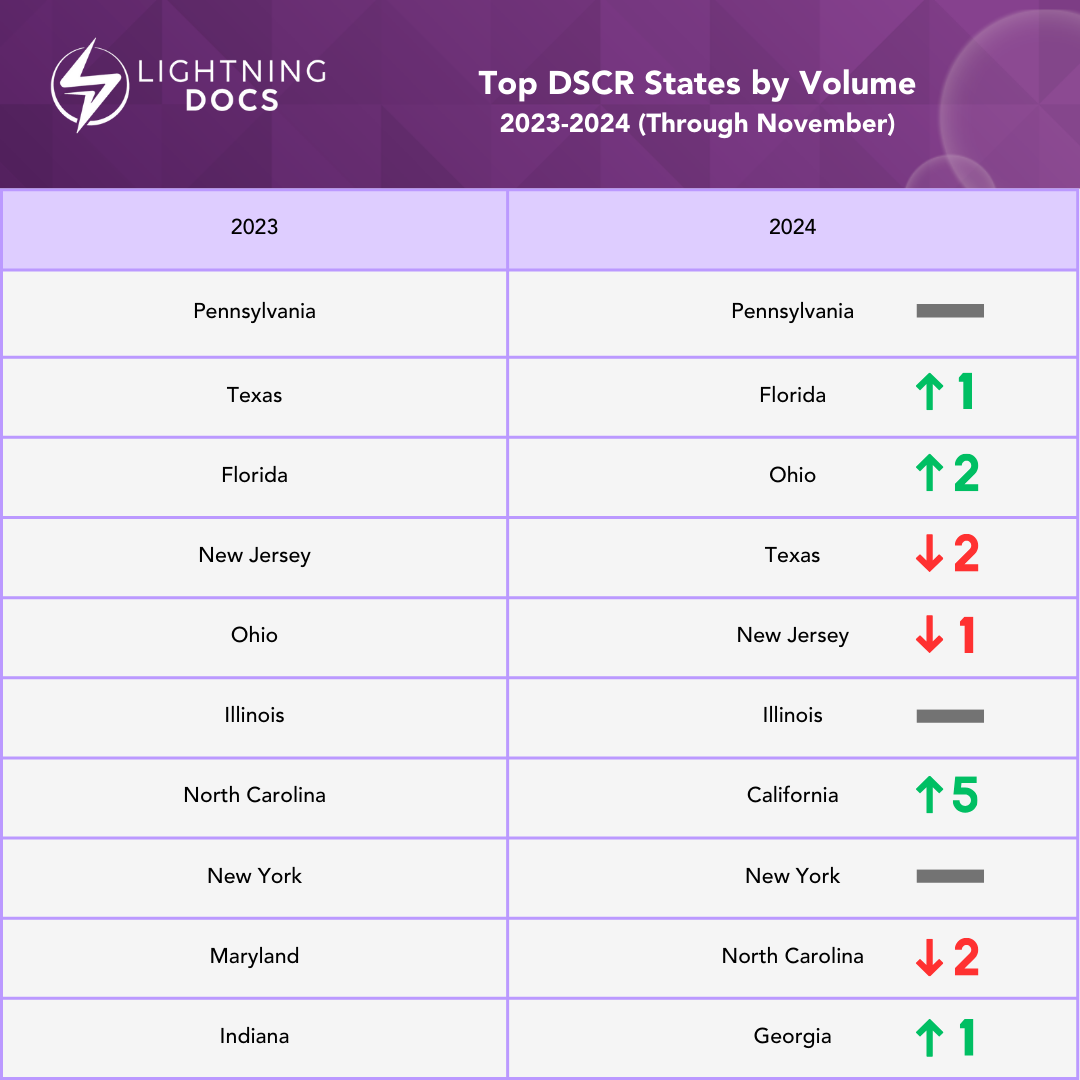

However, for DSCR there was significant shift in activity as rate changes provided opportunities for markets that were previously not desirable in 8%+ environments of 2023. For example, California jumped up 5 spots and was the 7th most popular state for DSCR loans nationally.

What to expect for 2025?

By now, you’ve likely heard many predictions for 2025. Where we sit in December the most common expectation is that there will be little interest rate movement in the first half of 2025.

However, last year’s predictions were largely inaccurate. My advice: focus on fundamentals rather than popular opinion.

The truth is that our Lightning Docs users achieved greater than 30% growth year-over-year and they did that despite any significant change in market fundamentals. I know many of those customers personally, and the hard truth is they are just better business operators than their peers.

Execution matters more than anything, continue to focus on the best customer service experience for your clients, while minding your own P&L, and let the market do whatever it will do.

Click on the link below for the full annual data report through November 2024.

If you’d like to discuss the report further or have questions, feel free to reach out to Nema at n.daghbandan@lightningdocs.com.